Beautetrade.com

3 min Read

Korean cosmetics have taken the beauty world by storm. With the natural formulation and affordability, K-beauty has made its strong place as a strong contender among other brands. Make up , skin care, and other cosmetics products have gained so much popularity all over the world. K-beauty has transformed the way people perceive their natural skin and beauty. It focuses on enhancing the beauty from within and improving the skin naturally, eliminating extra cosmetics to cover the flaws. The famous Glass Skin concept was introduced by influencers using Korean beauty products to achieve clearer skin than ever before.

K-beauty products have given Korea what other products could never have. K-beauty has boosted the economy of the country due to massive demand. The industry has been growing rapidly due to frequent innovation and PR marketing. The revenue generated from the K-beauty products in the market in South Korea is projected to reach US$15.70bn in 2025. It is expected to grow annually by 2.63% (CAGR 2025-2030). The largest segment in this market is skin Care, with a market volume of US$9.69bn in 2025.

K-beauty products hold great market share due to the innovative formulations and minimalist approach when it comes to branding and packaging. Over the past decade, people all over the United States have been loving Korean products over their skin, resulting in creating a big market.

These products contain unique yet effective ingredients such as snail mucin, fermented ingredients, rice water etc were new to the people of the United States. Skin care enthusiasts have become very keen to use these products and find amazing benefits. Apart from that, K-beauty products aren’t very heavy on the pockets. As compared to the brands in the USA, K-beauty was very less expensive yet high in quality.

Last year, the U.S. imported more than $7.5 billion in cosmetics, according to numbers from the U.S. International Trade Commission. Approximately $1.7 billion of those imports came from South Korea. In recent years, retailers have seen a boom in Korean skincare sales, in part thanks to social media influencers.

The top old products from K-beauty are serums, sheet masks, and sunscreen.

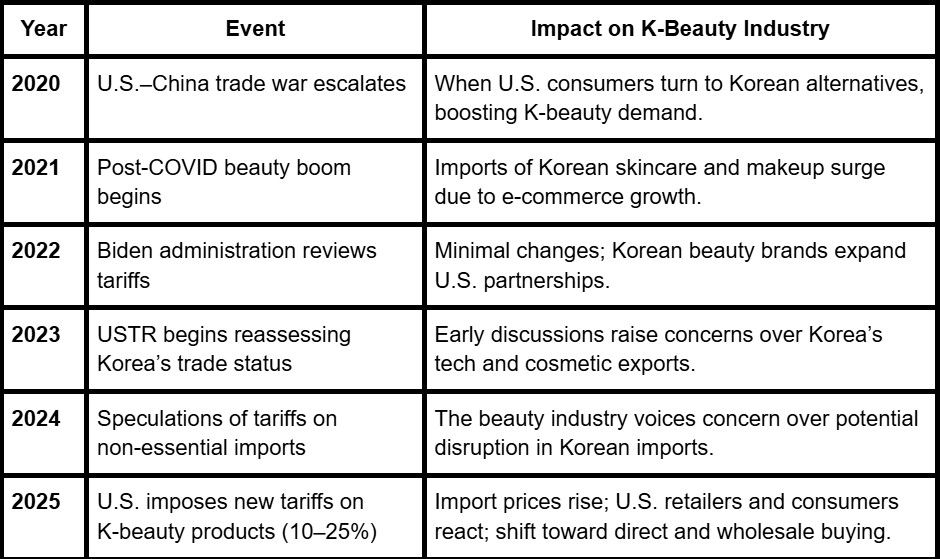

After the election of Donald Trump as the 47th President of the United States of America, things have been different. Lately, the United States has declared a tariff war with countries such as China, Korea, Vietnam, Taiwan and other European countries. The increased tariff percentage has also affected neighboring countries such Mexico and Canada, affecting the trade harmony among nations with the US.

The United States has announced a 10% tariff on beauty and cosmetic products imports from South Korea which has significantly affected the sales. This tariff war would bring a lot of consequences. A significant effect would be the rise in prices of all beauty products including K-beauty products. These products will become more expensive or harder to find due to low imports.

In response to this tariff declaration, Korea has decided to increase the cost of production.

American consumers, especially Gen Z and millennials, are reacting sharply to rising K-Beauty prices caused by new tariffs. According to CBS News, they are “panic-buying” Korean beauty products. They all saw it coming and don’t want to get left behind from restocking their favourite brands’ skincare products.

Many loyal customers are seeking affordable alternatives or buying in bulk during online sales. Some are switching to dupes or domestic K-beauty-inspired brands, while others are shifting purchasing habits to Korean websites to bypass U.S. tariff markups.

The shift reveals how price-sensitive the skincare category is, even for cult-favorite K-beauty brands. Despite the tariffs, brand loyalty remains strong but only if retailers and sellers find ways to offer competitive value without compromising product quality.

The 2025 U.S. tariffs on imported cosmetics particularly affecting K-beauty have caused a deep effect in the entire beauty industry. Higher import costs will cause retail prices for K-beauty products to rise by 10–25%. This hike will make once-affordable favorites like essence toners, cushion foundations, and sheet masks less accessible.

Retailers are shifting focus to non-tariff-impacted regions. The beauty supply chain is experiencing a sudden change and forcing the U.S. distributors to either work with extra costs, raise prices, or rethink their sourcing strategies entirely to avoid losing the market.

The negative consequences of this tariff ware are related to the economy of both countries. The consumers situated in the USA now have to face the raised, inflated prices of K-beauty products. Small beauty retailers. Brands who are highly dependent on selling direct Korean imports are now stuck with bulk stuck shipments due to pricing uncertainty.

Many private-label deals with Korean manufacturers are being paused or canceled, affecting product development cycles. Ultimately, this created a tension in the mind of the consumer and it will weaken the competitive edge that K-beauty once held in the U.S. beauty market.

Despite the economic stress, some positive shifts have also been seen. U.S.-based Korean beauty brands are investing more in local production which can be the best affordable option if US brands start manufacturing locally. Many brands are renewing interest in OEM partnerships within the U.S. and Mexico-based cosmetic production.

These changes may make the beauty ecosystem smooth in the long term, as both manufacturers and buyers seek smarter solutions and creative product sourcing strategies to retain customer satisfaction.

Tariffs don't have to mean the end of affordable K-beauty in the U.S. Buyers can still access competitive pricing by leveraging smarter product sourcing methods. They could establish direct relationships with South Korean manufacturers.

Private label manufacturing with flexible packaging and formulation options help in avoiding brand-related tariffs. B2B Platforms like Tradewheel.com and BeauteTrade offer genuine Korean suppliers who specialize in export. Wholesale purchasing and private labeling now play a bigger role in keeping pricing attractive while staying in compliance with tariffs.

Following are some ways to get the best prices amid the tariff war:

One of the most effective ways to get around tariff price hikes is by sourcing directly from Korean manufacturers through B2B platforms. Websites like Tradwheel.com, Alibaba.com, and BeauteTrade connect U.S. buyers to verified Korean brands and private label manufacturers. Buying in bulk directly from the source enables better negotiation on pricing, shipping, and formulation customization. B2B sourcing also ensures product authenticity, full time stock availability, and often faster production cycles. For distributors and resellers, this direct line to Korea can help in getting some relief from tariff-related prices.

Purchasing from Korean beauty brands that maintain inventory in U.S.-based warehouses is another smart strategy. By storing products domestically before tariffs are applied or working with third-party logistics companies, brands can offer competitive pricing. Many top K-beauty names, including Laneige, COSRX, and Etude, have established fulfillment partnerships in the U.S. This approach benefits wholesalers and online retailers who want to avoid customs delays or fluctuating tariff regulations. Local warehousing also supports improving delivery times and reducing bulk shipment risks while still offering genuine K-beauty products.

Switching to OEM (Original Equipment Manufacturing) and private label production allows buyers to avoid the premium costs of branded K-beauty while keeping the same quality. Korean manufacturers often offer white-label solutions, where U.S. companies can create their own skincare or makeup line using Korean formulations.

These private label products are often not subject to the same tariffs as finished branded goods. It’s a great way for small businesses or B2B resellers to maintain pricing, own their brand, and customize ingredients or packaging while still keeping up with the trusted innovation of Korean cosmetic formula.

Buying K-beauty products wholesale in larger volumes helps distribute tariff costs across more units, reducing the effective per-product price. This is especially valuable for resellers, beauty salons, and small retailers. Wholesalers working with Korean brands may have tariff exemptions on certain product categories or may already have pre-tariff pricing locked in through long-term contracts. Bundling purchases and collaborating in group buys with other U.S. buyers also lowers costs and risk.

While the new tariffs have created hurdles for importing K-beauty products into the U.S., they have also opened the door to smarter sourcing strategies and innovation. Consumers still love Korean skincare for its quality, effectiveness, and trends, and demand remains high. Businesses that adapt by using B2B platforms, warehouse solutions, OEM production, and wholesale buying will stay competitive. The future of K-beauty in the U.S. market will be defined by resilience, flexibility, and creative distribution models. For both suppliers and buyers, success lies in rethinking how products are sourced, packaged, and delivered to beauty-savvy customers.