Beautetrade.com

3 min Read

The global world of trade is experiencing a tough time because of extremely high tariffs imposed by the US government to promote industrialization. These tariffs have impacted almost every country across virtually any trade sector.

The beauty industry is vast and interconnected with global networks, which rely heavily on international trade. Whether it's sourcing high-quality ingredients, products, packaging, or anything else, the recent 10% reciprocal tariff by the US has shaken the world of the global beauty industry. This blog will discuss everything relevant to the worldwide beauty industry, how these high tariffs will reshape the cosmetics industry, and how they will impact the global supply chain.

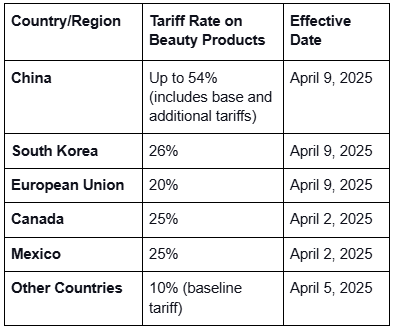

On 2 April 2025, the USA introduced new tariffs, a 10% baseline tariff on all imports. It has deeply affected the global trading industries. Countries like South Korea, China, Japan, Brazil, the UK, and Singapore are some of the countries for their top quality import and export of beauty and personal care products. If US businesses import beauty products, they will also have to pay a 10% baseline tariff with the additional duties. These tariffs were designed to address trade imbalances and protect domestic industries but have unintended consequences for beauty sectors.

1_Skincare and cosmetics sector, including serums, creams, makeup

2_Ingredients used in beauty care products, including oils, preservatives, pigments

3_Packaging industry, including tubes, glass bottles, plastic components

4_These high tariffs force companies to rely heavily on imports to reevaluate their supply chain strategies.

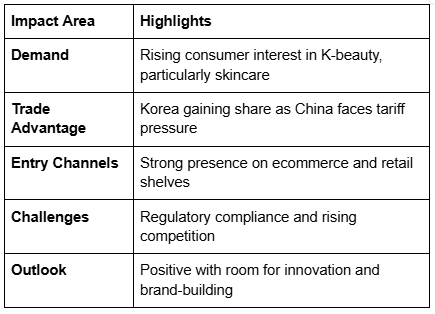

The K-beauty industry has recently gained much attention because of consumer preferences for skin care products. These products are known for their innovation, effectiveness, formulation, attractive packaging, and cost-effectiveness. Sheet masks, serums and ampoules, cushion compacts, and cleaners with fermented ingredients are the highest-selling products exported worldwide.

According to the Korea International Trade Association (KITA), cosmetic exports from South Korea to the US grew by over 30% year-on-year in 2023 and have maintained a steady upward trend into 2025.

While the trade war between China and the USA is in full swing, South Korea has become a center of attention for global importers. It is the best alternative for sourcing high-quality makeup products.

This shift is creating more room for Korean OEM/ODM suppliers and private label services to expand their footprint in the US.

It has opened the door for South Korean beauty care industries to enter the US beauty market through top-selling retail stores like Sephora, Ulta, and Amazon.

One of the immediate effects of tariffs is the disruption of global supply chains. Many beauty brands, especially mid-sized and indie players, depend on cost-effective sourcing from Asia.

Tariffs on raw materials such as shea butter, mica, and botanical extracts result in high formulation costs.

Due to low costs and customization options, Chinese manufacturers have long dominated the beauty packaging industry. Tariffs are forcing brands to seek alternatives.

Because of high tariffs imposed on China and Vietnam, US businesses are now finding other reasonable alternatives like India, South Korea, and Mexico, as well as cost-effective logistics and supply chains.

As the cost of imported beauty products rises, brands pass these increases on to consumers. According to industry reports, in 2024–2025, prices of skincare and cosmetic items in the US saw an average uptick of 7–12%.

This hike in the beauty and personal care products industry has brought mixed reactions among customers and manufacturers.

Some manufacturers plan to set up business domestically to save freight and shipping costs and taxes. Consumers now prefer to purchase low-priced, effective products.

Shoppers are looking for brands that offer better ingredient transparency and product longevity.

To stay competitive, brands reformulate products with locally available ingredients, reduce package sizes, or launch smaller SKUs.

Beauty brands are planning their next move wisely to offset the effect of high tariffs.

Many brands are considering moving manufacturing to Homie, while others are looking for reasonable options in countries with low tariffs and easy trade agreements.

Many importers are trying to contact local manufacturers and private label producers so they do not have to pay additional tariffs.

Countries like South Korea and Mexico are gaining a larger share of beauty manufacturing as brands shift sourcing from tariff-heavy zones.

US domestic manufacturers are seeing increased demand for contract manufacturing, packaging, and ingredient supply. Doing so will soon achieve the protectionist trade agenda results, and the US exports will increase while imports will become limited.

Entrepreneurs entering the market with U.S.-sourced private-label brands are capitalizing on consumer shifts.

Importers and retailers partnered with Chinese manufacturers are now losing money because of high trade taxes that have been imposed globally since 9 April.

The US beauty industry is experiencing a marked shift toward domestic manufacturing due to rising import tariffs and global supply chain disruptions. With international sourcing, particularly from countries like China, becoming more expensive and unpredictable, many brands are investing in local production facilities.

Major players such as Mana Products and Garcoa Labs have significantly expanded their US operations to meet growing demand from established and emerging beauty brands. Additionally, a network of U.S.-based suppliers like FusionPKG and Cosmetic Solutions has flourished, providing high-quality packaging and raw materials that support a more self-sufficient supply chain.

This shift is a tactical response to tariffs and a strategic move to gain tighter control over quality, improve production speed, and align with the increasing consumer demand for locally made products. Manufacturing hubs are developing rapidly in key states like California, Texas, and New Jersey, where infrastructure, talent, and logistics align to support industry needs.

While domestic production may come with higher initial costs, many brands see long-term advantages such as shorter lead times, brand trust, and reduced exposure to geopolitical risks. These benefits make U.S.-based manufacturing an increasingly attractive option in today's beauty market.

The US beauty industry makes strategic changes toward domestic production because of increasing import taxes and worldwide supply chain breakdowns. Many brands are building their production facilities because international sourcing costs are rising, and supply is becoming increasingly unpredictable, especially from Chinese suppliers.

The US operations of Mana Products and Garcoa Labs have grown substantially to accommodate rising product requirements from the established and emerging beauty brands sector. The U.S.-based suppliers FusionPKG and Cosmetic Solutions operate as a network providing high-quality packaging and raw materials, contributing to independent supply chain operations. The shift represents tactical and strategic benefits that enable better quality control, quicker production speeds, and increased local product appeal.

The states of California, Texas, and New Jersey have launched rapid manufacturing hub development since their infrastructure workforce and supply chain management systems fit industry requirements. Higher production expenses within the United States benefit brands through accelerated delivery times, enhanced brand reputation, and reduced global political uncertainties. Manufacturing operations within the United States continue to attract the beauty market through multiple benefits.

This blog has discussed how US tariffs reshape the global beauty product industry. Countries charged with high tariffs are at a loss, while those with low tariffs benefit from partnering up with US importers and fulfilling their product requirements with top-quality products. Buyers navigating their path to new manufacturers and suppliers should explore online trading platforms like Tradewheel.com, BeauteTrade.com, etc, to connect with manufacturers of low-tariff countries for seamless import and export.